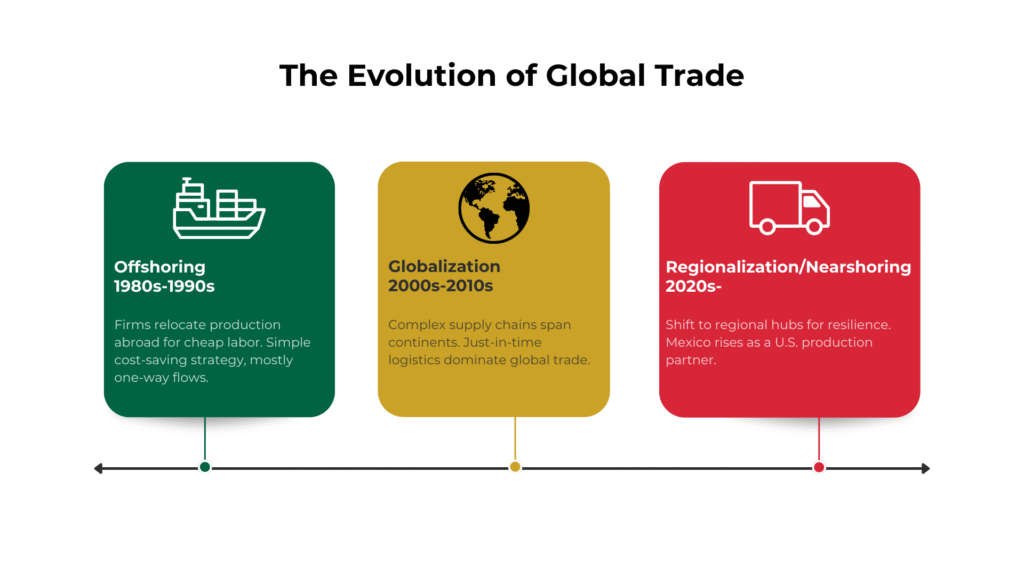

Global supply chains are undergoing a historic transformation. After decades of hyper-globalization built on low-cost offshore production, multinational firms are now prioritizing resilience, proximity, and strategic alignment over pure efficiency. Trade disruptions during the COVID-19 pandemic, rising geopolitical tensions between the United States and China, and mounting ESG compliance requirements have accelerated this shift from globalization to regionalization. Within this new trade geometry, Mexico has emerged as one of the most attractive destinations for nearshoring.

Anchored by the United States–Mexico–Canada Agreement (USMCA), Mexico offers a unique combination of tariff-free access to North America, competitive labor costs, and geographic proximity to the world’s largest consumer market. Its dense network of free trade agreements connects it to more than 60% of global GDP, enabling companies to position Mexico as both a regional and international export hub. In parallel, the country’s skilled workforce, growing foreign investment, and alignment with sustainability norms are reinforcing its competitiveness.

This article explores why Mexico is becoming a global hub for manufacturing and supply chains. It examines the historical and institutional context, the structural advantages fueling nearshoring, the industries leading this transformation, the ESG imperatives driving investment choices, the challenges that could constrain growth, and Mexico’s long-term role in reshaping international trade. Together, these elements highlight how Mexico is transitioning from a peripheral manufacturing base into a central node in the future of global commerce.

Historical Context: Mexico’s Trade Evolution

Mexico’s manufacturing rise is not a recent phenomenon, it is the result of decades of trade and investment liberalization.

From NAFTA to USMCA

In 1994, the North American Free Trade Agreement (NAFTA) marked a turning point in Mexico’s economic evolution, integrating it into the broader North American production ecosystem. The agreement eliminated most tariffs between the United States, Mexico, and Canada, transforming Mexico into a preferred destination for manufacturing-intensive industries such as automotive, electronics, machinery, and textiles.

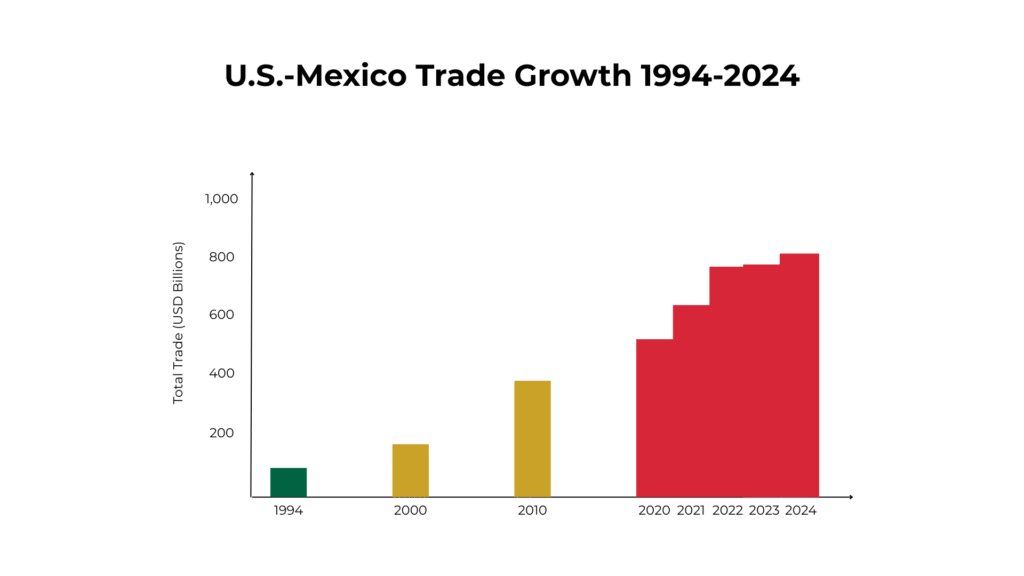

Over the course of 25 years, NAFTA reshaped trade flows and production strategies:

- U.S.–Mexico trade surged by over 500% between 1994 and 2020.

- Mexico’s share of U.S. imports steadily increased, making it the largest U.S. trade partner by 2023.

- Thousands of multinational firms established operations in Mexico’s maquiladora zones, especially along the U.S. border.

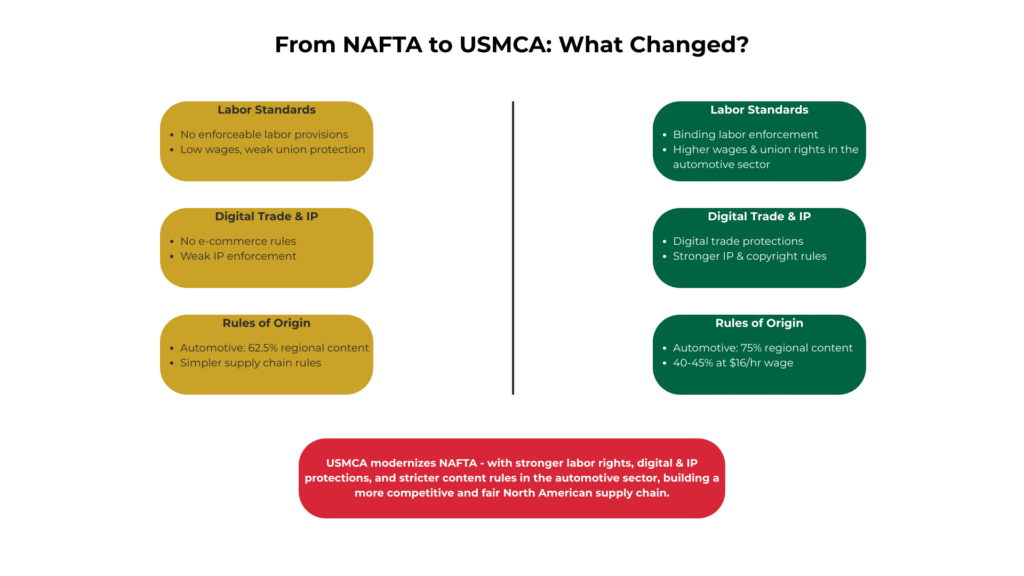

However, while NAFTA succeeded in boosting trade volumes, it also faced criticism for outdated rules of origin, weak labor provisions, and lack of environmental protections. Recognizing the need for a more modern and balanced framework, the agreement was renegotiated.

In 2020, NAFTA was replaced by the United States-Mexico-Canada Agreement (USMCA), known as T-MEC in Mexico and CUSMA in Canada. USMCA introduced major updates to address 21st-century trade challenges:

- Stricter rules of origin, particularly in the automotive sector, to encourage more regional content.

- Higher labor standards, including wage thresholds and enforcement mechanisms.

- E-commerce provisions, such as digital trade protections, cross-border data flow allowances, and customs simplification.

- Stronger IP protections, benefiting technology and pharmaceutical firms.

- The Six-Year Review Clause, which mandates a review every six years and a 16-year sunset clause, adds both flexibility and predictability for investors.

Crucially, the USMCA retains the core benefit of tariff-free trade across the continent, which significantly reduces costs for manufacturers relocating from overseas. It also reduces regulatory fragmentation between the three countries, allowing for smoother logistics, fewer trade disputes, and integrated supply planning.

This modernized trade framework has had a profound effect on nearshoring dynamics:

- The legal certainty and regional sourcing incentives embedded in USMCA are encouraging U.S. and Canadian companies to shift suppliers and operations to Mexico.

- It provides a competitive edge over Asian exporters who do not enjoy preferential access to the U.S. market.

- According to BCG, the U.S.–Mexico trade corridor is projected to grow by $315 billion by 2033, representing a compound annual growth rate (CAGR) of 4%, making it one of the fastest-growing trade relationships in the world.

Furthermore, with growing emphasis on friendshoring and strategic autonomy, the USMCA positions Mexico as a trusted partner in the Western Hemisphere, economically aligned with the U.S. and Canada, and insulated from many of the political and logistical risks facing offshore manufacturing hubs.

In summary, the shift from NAFTA to USMCA reflects more than a name change, it represents a recalibration of North American trade for a world defined by digital commerce, environmental accountability, and geopolitical fragmentation. For companies considering nearshoring, the USMCA is not only a framework for tariff savings, but a catalyst for regional resilience, investor confidence, and long-term supply chain integration.

Platform for Global Trade

While Mexico’s integration with the United States and Canada via the USMCA forms the core of its nearshoring appeal, the country’s broader network of trade agreements positions it as a powerful platform for global trade and manufacturing.

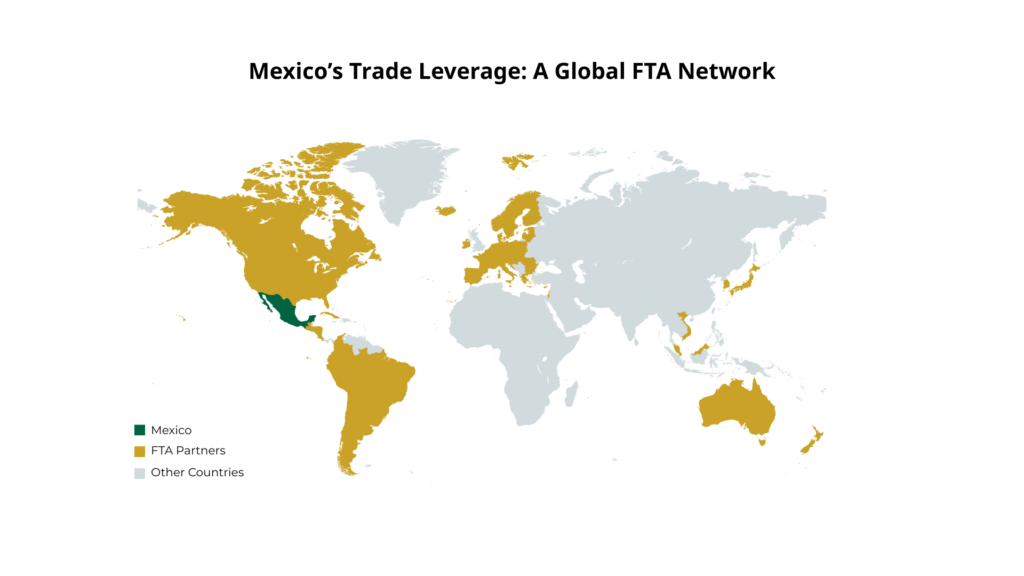

As of 2025, Mexico has signed 13 Free Trade Agreements (FTAs) covering over 50 countries, making it one of the most globally connected economies among emerging markets. This network spans North America, Europe, Latin America, and Asia-Pacific, giving Mexico preferential or tariff-free access to more than 60% of global GDP.

Comprehensive Global Trade Agreements

Some of Mexico’s most strategically important FTAs include:

- European Union – Mexico FTA (1997, modernized in 2025): One of the EU’s earliest agreements with a Latin American country. The new modernized Global Agreement expands market access in agriculture, services, and public procurement, strengthens sustainability and labor provisions, and extends protection for geographical indications, positioning Mexico as a strategic partner for Europe’s green and resilient supply chains.

- Mexico–Japan Economic Partnership Agreement (2005): The first FTA Japan signed with a Latin American country, facilitating trade in auto parts, electronics, and chemicals.

- Mexico–South Korea FTA (in negotiation/finalization): Though not fully ratified yet, Mexico and South Korea have established closer economic cooperation, especially in technology and electronics.

- Pacific Alliance (Mexico, Colombia, Peru, Chile): A Latin American trade bloc promoting the free movement of goods, services, capital, and people across member states.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): Mexico is one of 11 countries in this high-standard regional trade agreement spanning Asia-Pacific and the Americas, including countries like Japan, Australia, Canada, Chile, and Vietnam. The CPTPP not only facilitates trade but also enhances Mexico’s geostrategic flexibility, allowing it to hedge economic risks from U.S. dependency.

Trade Access as a Supply Chain Lever

This extensive web of agreements enables manufacturers in Mexico to export not only to North America but also to Europe, Asia, and South America without facing high tariffs or complex regulatory hurdles. For global companies setting up in Mexico, this means:

- Products manufactured in Mexico can qualify as regionally sourced when sold in multiple major markets, streamlining cross-border compliance.

- Companies can set up “export hubs” in Mexico to serve the Americas, EU, and parts of Asia with one consolidated production and distribution base.

- Access to raw materials and components from multiple trade partners reduces dependence on any single market (e.g., China) and allows supply chain redundancy.

This is especially advantageous for industries like:

- Automotive (regional content requirements in USMCA)

- Medical devices and pharmaceuticals (regulatory compliance with EU/U.S.)

- Textiles and apparel (shorter lead times and duty-free access to Europe and Asia)

- Electronics (sourcing of semiconductors and components from Japan, Taiwan, or Malaysia via CPTPP)

Integration into Global Value Chains (GVCs)

Mexico’s global connectivity is further reinforced by its:

- Active participation in global value chains in sectors like automotive, aerospace, and electronics.

- High foreign value-added share in its exports (especially in automotive), meaning Mexico is a key node in transnational production networks.

- Use of advanced customs and logistics technology to simplify re-export processes (e.g., IMMEX/Maquiladora program).

Why Nearshoring? Global Drivers Reshaping Production

Nearshoring is not driven by a single factor, it is the result of overlapping geopolitical, economic, and environmental disruptions:

Supply Chain Disruptions

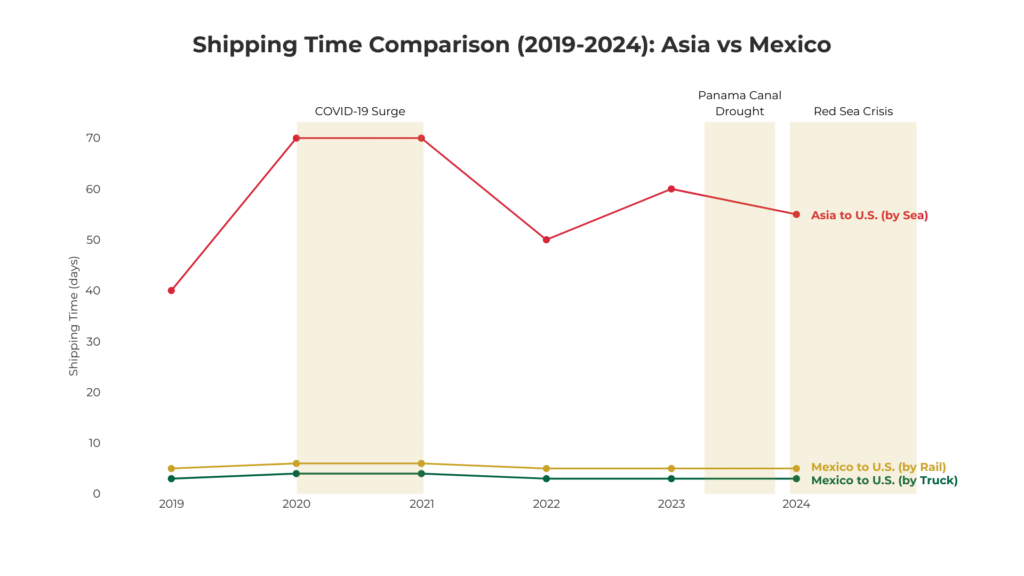

The COVID-19 pandemic laid bare the fragility of offshore manufacturing, exposing just how vulnerable global supply chains had become to systemic shocks. Between 2020 and 2022, shipping times from Asia to the United States doubled, straining delivery schedules and inventory planning. Major U.S. ports such as Los Angeles and Long Beach experienced severe congestion, with delays stretching up to 30 days at peak times, leaving goods stranded offshore and production lines idle. According to a McKinsey study, the average company can now expect a major supply chain disruption roughly every 3.7 years, underscoring the urgent need for more resilient, regionally based sourcing strategies.

US-China Decoupling

The relationship between the United States and China, once defined by economic interdependence, is undergoing a fundamental transformation. What began as a trade dispute in 2018 has evolved into a broader geostrategic decoupling. Rising tariffs, technology bans, sanctions, and political mistrust have prompted many U.S. and allied companies to rethink their reliance on Chinese manufacturing and sourcing.

Over the past several years, the U.S. has implemented multiple rounds of tariffs under Section 301, affecting hundreds of billions of dollars in Chinese imports. At the same time, export controls on sensitive technologies, especially semiconductors, AI components, and defense-related goods, have tightened. China has responded with its own set of retaliatory measures, including restrictions on rare earth exports, outbound investment screening, and growing support for domestic self-sufficiency.

These tensions have had a chilling effect on corporate strategy. According to a 2024 PwC CEO survey, over 40% of U.S. executives now plan to reduce their exposure to China, citing rising operational risks, compliance burdens, and political uncertainty. A separate report from the U.S. Chamber of Commerce confirms that companies are shifting procurement and production to “friendly” or regional partners, including Mexico, Vietnam, India, and Eastern Europe.

This decoupling is not limited to sensitive sectors. Even mainstream industries like consumer electronics, textiles, and medical devices are seeking alternatives to China’s once-dominant manufacturing ecosystem. As U.S. firms search for cost-competitive, stable, and geopolitically aligned locations, Mexico’s proximity, trade compatibility under USMCA, and manufacturing capacity make it a prime destination.

In this context, nearshoring to Mexico is not simply about efficiency, it’s a strategic hedge against escalating geopolitical risk, reinforcing supply chain resilience in an era of global fragmentation.

Energy and Shipping Volatility

Energy and shipping volatility have become defining risks of global supply chains. The pandemic, the Ever Given blockage of the Suez Canal, drought restrictions at the Panama Canal, and recent security crises in the Red Sea have underscored just how vulnerable long-distance maritime trade has become. At the same time, surging oil and gas prices have pushed freight costs to record highs, straining companies reliant on Asia–U.S. routes.

Nearshoring to Mexico reduces this exposure. Overland trucking and rail routes to the U.S. bypass maritime chokepoints entirely, shielding firms from disruptions that can shut down or delay cargo for weeks. Instead of navigating thousands of nautical miles, companies can operate on short-haul, fuel-stable corridors that make logistics costs far more predictable.

For businesses restructuring supply chains, the real advantage lies not only in lower costs but in risk reduction. By locating production in Mexico, companies trade the uncertainty of volatile global shipping for the stability of a secure, regional supply system.

ESG and Regulatory Compliance

In today’s regulatory environment, Environmental, Social, and Governance (ESG) compliance is no longer optional, it’s a strategic necessity. Laws such as the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) and the U.S. Uyghur Forced Labor Prevention Act (UFLPA) are placing legal and reputational pressure on companies to trace their supply chains, ensure ethical labor practices, and reduce environmental harm.

Global firms are now held accountable for the behavior of their suppliers, not only directly, but across multiple tiers. This is particularly challenging with offshore production in distant, opaque environments, where visibility and control are limited.

Nearshoring to Mexico provides a powerful solution. Its proximity to the U.S. and Canada enables tighter oversight, faster response times to regulatory changes, and greater alignment with Western ESG norms. Labor reforms under the USMCA have improved workplace standards and union rights, helping ensure compliance with social criteria. Additionally, Mexico’s growing interest in renewable energy and waste reduction supports environmental objectives.

For companies facing rising ESG disclosure requirements and third-party audit obligations, relocating supply chains to Mexico not only reduces risk, it builds a foundation of transparency, traceability, and trust essential in a compliance-driven global economy.

Mexico’s Competitive Advantage

Mexico offers a compelling mix of structural, operational, and strategic advantages that make it the leading nearshoring destination in the Western Hemisphere.

Strategic Proximity

Mexico’s geographic proximity to the United States, its largest trading partner, offers a strategic edge that few global manufacturing hubs can match. Sharing a 3,000 km land border, Mexico enables direct overland shipping to the U.S. with same-day or next-day delivery capabilities to major markets such as Texas, California, and Arizona, and within just a few days to the Midwest and East Coast.

This physical closeness provides a powerful antidote to the risks and inefficiencies associated with long-haul global shipping. Compared to Asia-based suppliers, where transit times can stretch from 30 to 45 days from China or 25 to 40 days from Vietnam, goods produced in Mexico can reach U.S. distribution centers in 1 to 5 days by truck or rail.

This speed drastically reduces lead times, inventory holding costs, and the need for buffer stock. For industries like automotive, electronics, and retail, where rapid restocking and just-in-time production are critical, shorter delivery windows can be the difference between meeting market demand or losing sales.

Moreover, land-based transportation from Mexico helps companies avoid maritime choke points such as the Suez Canal, Panama Canal, and the congested U.S. West Coast ports, which have experienced persistent delays and capacity issues. Rail and highway infrastructure connecting Mexico’s northern states to the U.S. is highly developed, with major logistics corridors like the NAFTA Superhighway (now USMCA Corridor) facilitating seamless cross-border flow.

This geographical advantage also enhances supply chain agility, enabling quicker response to demand shifts, easier reverse logistics, and lower environmental impact compared to trans-Pacific shipping.

In short, Mexico’s proximity is not just a logistical benefit, it is a strategic asset that allows companies to build faster, leaner, and more resilient supply chains at a time when speed, certainty, and sustainability are redefining global competitiveness.

Labor Cost Competitiveness

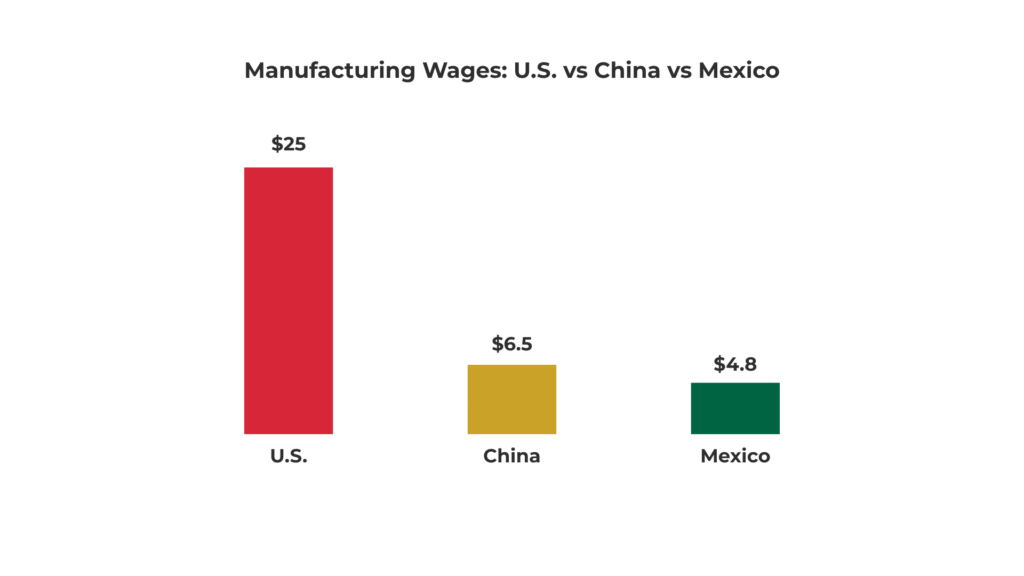

One of Mexico’s most compelling advantages as a nearshoring destination lies in its highly competitive labor costs, a critical consideration for companies recalibrating global sourcing strategies. As of 2023, Mexico offers average hourly manufacturing wages of approximately $4.80, compared to $6.50 in China and over $25.00 in the United States. That represents a wage savings of up to 70–80% versus U.S. labor, and a modest but growing edge over China.

But wages are just part of the equation. Mexico combines low costs with solid productivity, especially in export-oriented sectors like automotive, aerospace, and electronics. Industrial clusters in Nuevo León, Guanajuato, and Querétaro are home to a growing number of technically trained workers, supported by dual-education programs and partnerships with foreign investors. In northern border states, the presence of established maquiladora networks provides ready-made talent pools accustomed to U.S. standards and processes.

Meanwhile, China’s labor cost advantage is shrinking. Over the past decade, Chinese wages have grown at an average annual rate of 7–10%, fueled by a tightening labor market, demographic decline, and rising compliance costs tied to ESG and trade tensions. Mexico, by contrast, maintains stable wage growth while still offering favorable currency exchange rates, low employee benefit burdens, and strong alignment with U.S. labor norms under USMCA.

Additionally, Mexico’s time zone alignment with the U.S. facilitates real-time collaboration, management oversight, and faster turnaround, an operational advantage not captured in wage comparisons alone.

For labor-intensive industries like apparel, furniture, and consumer goods, or for value-added manufacturing sectors like automotive components and electronics, Mexico offers an ideal balance of cost, quality, and control. It’s not just about saving money; it’s about building flexible, resilient operations closer to market, without compromising standards.

In the nearshoring equation, labor cost competitiveness is not merely a short-term advantage, it’s a strategic enabler of long-term regional growth and supply chain stability.

Deep Trade Integration

Mexico’s integration into North American trade is not just defined by treaties, it is embedded in the everyday flow of goods, services, and data across its borders. While the USMCA provides the legal foundation, Mexico’s real strength lies in how deeply its economy is intertwined with U.S. and Canadian production systems. This operational integration gives manufacturers in Mexico a near-frictionless platform for North American market access.

Automotive, electronics, and aerospace production often cross borders multiple times during assembly. A Detroit-built car, for example, might contain engine components cast in Guanajuato, wiring harnesses assembled in Chihuahua, and software coded in Jalisco. This type of looped manufacturing depends on predictable, synchronized trade flows, supported by Mexico’s logistics infrastructure and binational coordination.

For companies nearshoring to Mexico, this deep integration offers efficiency, legal predictability, and real-time coordination. It enables firms to design complex regional value chains that are not only cost-effective, but also resilient, scalable, and compliant with North American standards, a competitive edge that few other global locations can match.

Skilled Workforce and Demographics

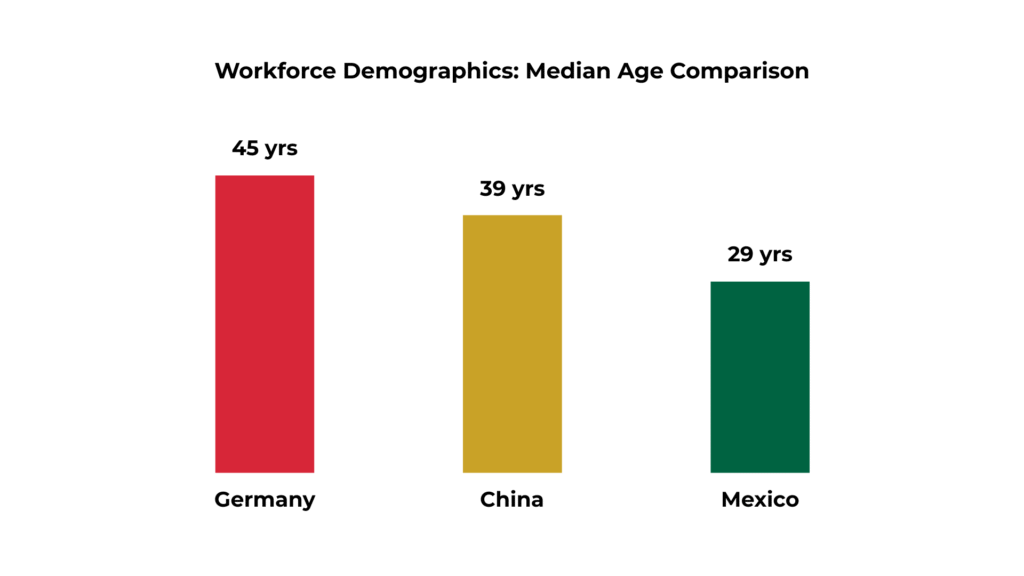

Beyond cost considerations, one of Mexico’s most underappreciated strengths is the quality and demographic structure of its labor force. In an era where many advanced and emerging economies face labor shortages and aging populations, Mexico offers companies a sustainable supply of young, trainable, and technically skilled talent, a crucial ingredient for long-term nearshoring strategies.

With a median age of 29, Mexico has one of the youngest populations in the OECD. This demographic advantage translates into a steady stream of working-age citizens entering the labor market each year, helping to avoid the wage inflation and productivity drag now plaguing aging economies such as China (median age: 39), South Korea (44), and Germany (47).

Critically, Mexico is not just young, it is increasingly skilled. The country graduates more than 115,000 engineers annually, placing it among the top engineering talent producers in the Americas. On a per capita basis, Mexico produces more engineers than the U.S., and universities in states like Nuevo León, Jalisco, and Querétaro have forged partnerships with industry to align curricula with real-world manufacturing and technology needs. Technical institutes and dual-education models, often supported by German or Japanese investors, are rapidly expanding workforce readiness in industrial hubs.

In high-demand fields such as mechatronics, industrial automation, robotics, and software engineering, Mexico is developing niche capabilities that complement its traditional strengths in mechanical and electrical engineering. The rise of clusters like Guadalajara’s “Mexican Silicon Valley” further showcases the country’s ambition to move up the value chain in tech-enabled manufacturing.

Moreover, the cultural and time zone alignment with the U.S. makes it easier for multinational firms to manage training, communication, and remote coordination. With many young professionals fluent in both Spanish and English, companies benefit from smoother cross-border collaboration without the linguistic or scheduling barriers that exist in more distant regions.

In short, Mexico’s combination of youthful demographics, strong technical education, and workforce adaptability makes it a long-term human capital asset. For firms building the factories and supply chains of the future, Mexico offers both the scale and the skill needed to succeed.

Foreign Investment Momentum

Mexico’s position as a nearshoring powerhouse is not just theoretical, it’s being validated by a surge in foreign direct investment (FDI) from some of the world’s largest industrial and technology companies. In 2023, Mexico attracted over $36 billion in FDI, a 30% increase compared to the previous year and the highest level in nearly a decade. This momentum is a clear signal of investor confidence in Mexico’s long-term role as a manufacturing and logistics hub for the Americas.

A growing share of these investments are nearshoring-related, focused on sectors such as automotive, electronics, aerospace, logistics, and green energy. Global brands like Foxconn, Bosch, and Schneider Electric are establishing or expanding their presence in Mexico to shorten supply chains, reduce geopolitical risk, and tap into the U.S. market under USMCA trade preferences.

- In 2023, Tesla announced plans to build a “gigafactory” in Monterrey, Nuevo León, estimated at over $5 billion, aimed at producing next-generation electric vehicles.

- Foxconn, a major supplier for Apple, expanded operations in Chihuahua to support electronics manufacturing with faster access to North American clients.

- Bosch opened a new plant in Querétaro for electric motor production as part of its global EV strategy.

- Schneider Electric and other multinational firms are deepening their investments in smart manufacturing and energy efficiency solutions, leveraging Mexico’s skilled technical workforce.

Beyond big names, industrial park developers and logistics providers are also scaling up. According to real estate data, industrial park occupancy in northern Mexico exceeded 97% in 2023, with hundreds of new projects underway to accommodate incoming manufacturers.

Mexico’s geographic advantage, competitive costs, and trade access are now enhanced by a wave of infrastructure upgrades, from new rail bridges at the U.S. border to digital customs systems and expanded renewable energy capacity—all of which further attract long-term investors.

As companies look to derisk global operations and regionalize supply chains, Mexico is capturing a disproportionate share of capital reallocation. The result is not just a short-term boom, but a structural shift toward Mexico as a high-value investment platform in the emerging regional order.

The New Global Trade Geometry

The global trade landscape is undergoing a profound and permanent transformation. For decades, supply chains were organized around a central hub, China, which served as the world’s factory due to its vast manufacturing capacity, low labor costs, and integrated export infrastructure. However, a series of shocks and structural shifts have pushed governments and companies to move away from this single-center model toward a multi-regional system built on resilience, security, and political alignment.

This shift is what Boston Consulting Group (BCG) and KPMG have referred to as the rise of a ‘New Geometry of Trade.‘ It is marked by a transition from hyper-globalization to a more fragmented but flexible network of regional hubs. In this new configuration, friendshoring, regionalization, and trade bloc alignment are replacing the previous orthodoxy of pure cost efficiency.

Friendshoring: Aligning Trade with Political and Strategic Interests

One of the most significant drivers of the new trade architecture is friendshoring—the deliberate effort to relocate supply chains to politically stable and allied countries. This concept, increasingly popular among policymakers in the U.S., EU, and Japan, aims to reduce reliance on nations seen as geopolitical adversaries or sources of strategic risk.

The logic is simple: In a world where economic dependency can be weaponized—as seen in Russia’s energy exports or China’s rare earth dominance—trading with friendly nations ensures supply security, policy alignment, and mutual trust. Countries like Mexico, Vietnam, Poland, and India are among the key beneficiaries of this strategy.

For the U.S., this means shifting focus from China to regional allies like Mexico and Canada, where integrated supply chains can operate under shared legal frameworks like USMCA and benefit from aligned labor and environmental standards.

Regional Trade Corridors are Replacing Global Pipelines

Rather than relying on long, fragile, cross-ocean pipelines, trade is increasingly flowing through regional corridors built on geographic proximity and economic complementarity. Examples include:

- U.S.–Mexico: Automotive, electronics, and aerospace integration under USMCA.

- Germany–Czech Republic–Poland: Advanced manufacturing within the EU single market.

- Japan–Vietnam–Malaysia: Diversification of electronics and textiles in the Indo-Pacific

- China–ASEAN: Regional trade bolstered by RCEP, though increasingly fragmented due to geopolitical tensions

This emerging map is shaped not only by private sector adjustments, but also by state-led industrial policy. In the U.S., laws like the Inflation Reduction Act (IRA) and the CHIPS and Science Act are channeling hundreds of billions of dollars into domestic and regional manufacturing, especially in semiconductors, clean energy, and electric vehicles. These subsidies explicitly favor local or allied sourcing, accelerating the decoupling from Asia.

In parallel, energy independence, especially in North America, is a game changer. The U.S. and Canada have access to abundant oil, natural gas, and growing renewable energy capacity. Mexico, with its solar-rich northern states and wind corridors like Oaxaca, is increasingly positioned to contribute to a low-carbon, regional production platform—further incentivizing companies to nearshore.

Mexico’s Role in the New Trade Geometry

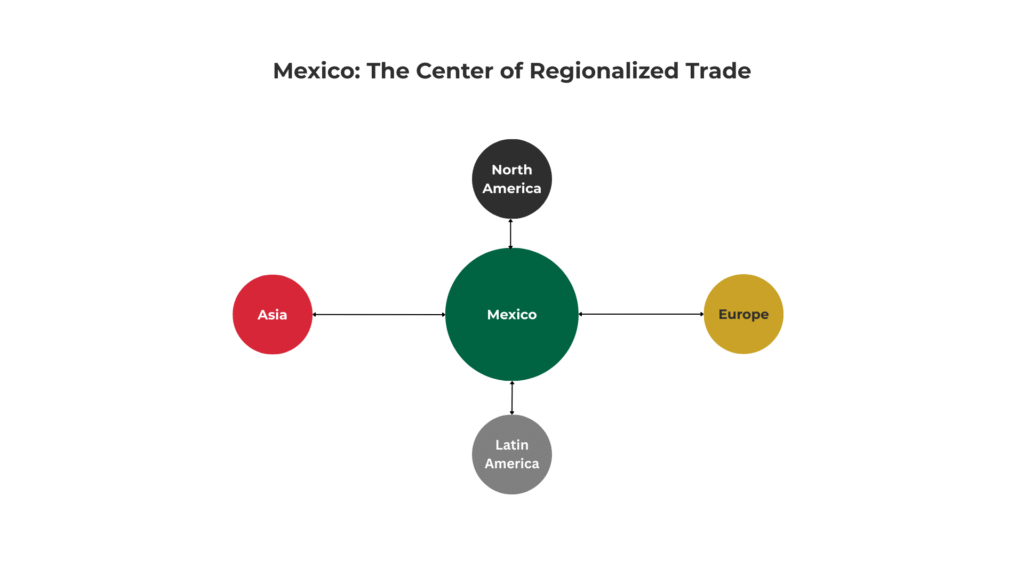

In this reconfiguration, Mexico plays a central and multi-dimensional role. It is not just a passive beneficiary of U.S. trade redirection—it is becoming the node in a resilient, multi-regional supply web that links North America with Latin America, Europe, and Asia.

Thanks to its extensive network of free trade agreements, Mexico gives companies a bridge between regional blocs. Inputs can be sourced globally, value added locally, and final goods exported duty-free into the U.S., Canada, and the EU—all while meeting complex rules of origin, labor standards, and ESG requirements in a strategically neutral location.

In this configuration, Mexico is no longer a peripheral low-cost base, it is the fulcrum of North America’s role in a world defined by regional hubs. The triad of North America, Europe, and East Asia will continue to dominate global commerce, but the way goods are sourced, processed, and shipped within and between these regions is changing. Mexico’s unique combination of proximity, trade alignment, labor force, and geopolitical neutrality places it at the center of this transformation, offering a platform that connects efficiency with resilience, and regional focus with global reach.

Regional Breakdown: Mexico’s Manufacturing Hubs

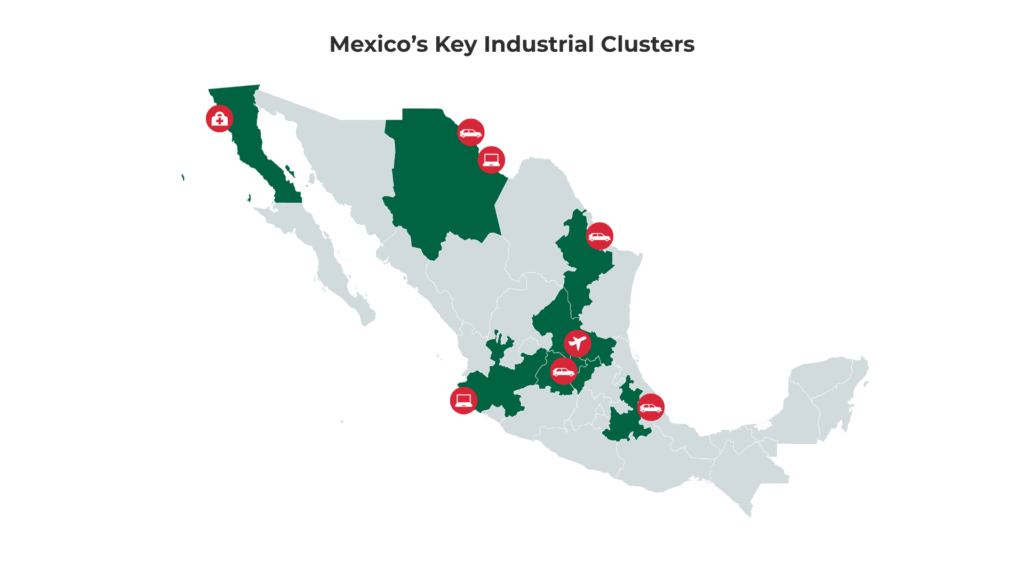

Mexico’s nearshoring appeal is not uniform, it is shaped by regional clusters with specialized strengths.

Nuevo León (Monterrey)

- Specializes in: Steel, electronics, automotive, logistics.

- Near U.S. border with Texas (Laredo).

- Home to major suppliers and high-end industrial parks.

Bajío Region (Querétaro, Guanajuato, Aguascalientes)

- Specializes in: Aerospace, automotive parts, and robotics.

- Known for skilled labor and engineering universities.

- Hosts companies like Bombardier, Continental, Brose.

Jalisco

- Nicknamed the “Mexican Silicon Valley”.

- Specializes in: Electronics, semiconductors, and medical devices.

- Foxconn, Flextronics, and Intel have operations here.

Chihuahua and Coahuila

- Border access to Texas and Arizona

- Specialize in: Aerospace, heavy equipment, solar and lithium mining

State of Mexico and Puebla

- Car assembly hub for VW, Audi, and Stellantis.

- Good Access to both north and central markets.

ESG and Sustainability in Nearshoring

Environmental, Social, and Governance (ESG) considerations are no longer optional, they are now central to global supply chain decisions. For companies exploring nearshoring, Mexico offers a unique opportunity to align cost competitiveness with sustainability and compliance.

On the environmental side, nearshoring dramatically reduces emissions. Shipping a container from China to the U.S. can emit more than ten times the CO₂ of trucking the same goods from northern Mexico. Combined with Mexico’s growing capacity in solar and wind energy, as well as circular economy initiatives in industrial clusters, manufacturers gain a pathway to greener operations without sacrificing efficiency.

Social compliance is also more straightforward in Mexico. Reforms tied to the USMCA have improved labor standards, wage enforcement, and union representation, helping foreign firms meet rising U.S. and EU due-diligence requirements on human rights and forced labor. For sectors like automotive and apparel, where supply chains face intense scrutiny, this alignment reduces both reputational and legal risks.

Finally, governance is improving in critical trade corridors. Mexico outperforms many emerging economies on intellectual property protections and arbitration, while digital customs platforms in northern Mexico and in the Bajío states are cutting red tape. These advances give companies greater transparency and predictability in cross-border operations.

The combined effect is that nearshoring to Mexico is not only about cost and speed, it is about building supply chains that are cleaner, more compliant, and more resilient. For firms facing ESG audits, investor scrutiny, and consumer pressure, producing in Mexico offers both a strategic advantage and a reputational shield.

Sectoral Spotlight: Key Industries Relocating to Mexico

As nearshoring gains momentum, Mexico is fast transforming from a cost-effective production locale into a hub for innovation-led, high-value manufacturing. Here’s a deeper dive into the sectors leading this wave:

Automotive & EVs

Mexico remains a global automotive manufacturing powerhouse, producing nearly 4 million vehicles in 2024, a 5.6% increase over 2023, and ranking as the world’s 4th largest automotive exporter. Nearshoring continues to attract investment: in 2023, the automotive sector captured $8.5 billion in FDI, accounting for approximately 40% of total investment into Mexico.

The EV segment is ramping up dramatically. From under 7,000 units in 2020, EV production surged to 206,870 in 2024, with 81,000 units manufactured in the first four months of 2025 alone. Production is expected to exceed 250,000 electric units by the end of 2025, marking a 21% increase year-over-year; the number of companies in the sector has grown 37% within just seven months. Meanwhile, BYD, a Chinese EV leader, forecasts doubling its Mexico sales from 50,000 in 2024 to 100,000 in 2025, with plans underway for a domestic manufacturing facility.

Electronics & Semiconductors

Electronics manufacturing is thriving: over $7.8 billion in FDI has flowed into the sector over the past two decades, with hubs concentrated in Baja California, Jalisco, Chihuahua, and Monterrey. In particular, Chihuahua leads national electronics exports, with a staggering $20.4 billion in 2024, thanks to major players like Foxconn and Jabil.

On the semiconductor front, Mexico, especially the Bajío and northern regions, is pushing to double its chip-making capacity by 2030 and attract $10 billion in investment, with assembly, testing, and packaging (ATP) as focal sub-sectors.

Aerospace

Mexico’s aerospace sector is soaring. With over 370 specialized facilities across 19 states, companies like Bombardier, Airbus, Boeing, GE Aviation, Safran, and Honeywell are entrenched in Mexico’s ecosystem. The industry generated $11.2 billion in sales in 2024 and is expected to nearly double to $22.7 billion by 2029, growing at around 15% annually. Querétaro, in particular, hosts over 80 aerospace firms, focusing on manufacturing, MRO, and R&D, while Chihuahua contributes 25% of factories producing metal and composite components.

Medical Devices

Mexico is the leading medical device supplier to the U.S., with the industry valued at over $16 billion in 2022, and featuring more than 2,000 manufacturing firms. Baja California, especially Tijuana and Mexicali, anchors this tren, home to over 70 companies employing tens of thousands, and serving both commercial and innovative sectors. Major global players like Medtronic (with six Mexican facilities), Siemens Healthineers, Becton Dickinson, Boston Scientific, and Abbott operate sizable plants and R&D centers across Mexico.

Consumer Goods & Apparel

Cost savings, reduced lead times, and increasing supply chain sustainability are fueling the shift of apparel production to Mexico. Although Asia still dominates U.S. apparel imports, Mexico’s presence has stabilized, accounting for around 7–8% of the U.S. market from 2017 to 2023. While-specific denim stats vary, Mexico has overtaken China in supplying denim at times, aided by its logistical proximity and nearshoring appeal.

Challanges and Contraints

While Mexico continues to rise as a nearshoring hub, the path is dotted with substantial obstacles that companies must strategically navigate.

Infrastructure Bottlenecks

Rapid demand for industrial space has surged, Monterrey and northern border markets alone absorbed about 1.7 million m² of industrial space by Q3 2024, marking a 14% increase year-over-year. Yet the country’s utilities and logistics systems are struggling to keep pace. Energy grids and water supply infrastructure, especially in high-growth zones, are under strain. For example, infrastructure gaps could limit further integration into global value chains.

Moreover, Mexico’s power sector lacks sufficient policy support for expansion and a transition to renewables, posing risks for companies with ESG and reliability considerations.

Security and Rule of Law

Organized crime continues to pose a major economic threat. A recent study estimated that cartel-related violence imposes an annual economic burden exceeding US $19 billion, about 2.5 times more than the government’s science and technology investment, and current funding remains insufficient to curb it meaningfully in the near term.

These security challenges contribute to elevated transport and supply insurance costs, especially in regions with elevated crime and extortion risks.

Bureaucracy, Corruption, and Permitting Complexities

Bottlenecks in permitting, labor law compliance, and zoning remain particularly entrenched in southern Mexico. Development of industrial Parks, critical for manufacturing expansión, has faced delays due to costly land acquisition, poor inter-agency coordination, and bureaucratic red tape. In some cases, corruption and administrative opacity have further hindered progress.

Furthermore, persistent risks of corrupt practices in public procurement continue to undermine equitable and efficient industrial development.

Trade Policy Uncertainty & USMCA Review

Mexico will face a USMCA review in 2026, triggering uncertainty around rules of origin, dispute resolution, and overall trade alignment.

Approximately half of Mexico’s exports to the U.S., particularly in automotive and electronics, do not currently meet USMCA origin standards and risk subjecting companies to 25% tariffs unless additional compliance steps are taken. This has spurred private equity firms to delay nearshoring deals while awaiting clarity on trade policy.

Environmental & Social Pressures

Nearshoring accelerates industrial activity in border regions already grappling with environmental stressors, air and water pollution, waste management issues, and ecological degradation. Without robust environmental safeguards and community engagement, the social license to operate in these areas may erode.

Bottom Line

Mexico’s nearshoring potential is promising, but companies must proactively address several intertwined challenges:

Infrastructure:

Invest in reliable energy and water solutions; consider locations with expanding intermodal facilities like the newly opened Puerto del Norte seaport in Matamoros, expected to boost logistics for northeastern industrial corridors.

Security:

Deploy risk mitigation and partner with local security experts; anticipate higher insurances and adapt accordingly.

Administrative Navigation:

Engage experienced local advisors to speed up licensing, and prioritize regions with streamlined processes and lower corruption risk.

Policy Monitoring:

Stay agile around trade developments, especially linked to the USMCA 2026 review and tariff shifts.

Community & Environmental Strategy:

Commit to environmental justice, resilience-based planning, and proactive stakeholder outreach to uphold sustainability and social credibility.

The Road Ahead: Mexico in the Future of Trade

As globalization gives way to regionalization, Mexico is increasingly positioned as the cornerstone of a modern North American economic bloc. A host of projections, policy shifts, and infrastructure developments are aligning to shape Mexico’s evolving role.

Strategic Outlook

A powerful shift in trade patterns is underway. Boston Consulting Group projects that if U.S.–Mexico tariffs remain stable, bilateral trade could grow by US $315 billion by 2033, representing a steady 4% compound annual growth rate (CAGR), positioning the corridor as one of the fastest-growing in the world.

Complementing this, geopolitical realignments are reinforcing Mexico’s strategic relevance. Changing global trade relationships and shifting supply chains, driven in part by U.S. policy and geopolitical concerns, are pushing firms to reconsider sourcing and manufacturing locations, with Mexico increasingly at the forefront.

Additionally, Mexico made history in 2023 by surpassing China as the largest trading partner of the U.S., cementing its position as a vital production platform and export base.

Policy Synergy

Mexico stands to benefit substantially from U.S. industrial strategies such as the CHIPS Act and the Inflation Reduction Act (IRA), both of which favor North American-made products, especially in semiconductor and renewable energy sectors. The convergence of these incentives with Mexico’s manufacturing capabilities could drive further investment into high-tech, clean-energy, and strategic industries.

Domestic investment promotion is also being reoriented. Emphasis is shifting toward green energy, digital infrastructure, and industrial clusters, echoing the regional development strategy of initiatives like the Interoceanic Corridor of the Isthmus of Tehuantepec. This corridor, connecting Pacific to Atlantic via modern rail and upgraded ports, aims to deliver up to US $50 billion in investment and create 550,000 jobs, potentially contributing 3–5% of GDP when fully operational.

Resilient Growth Path

Mexico’s long-term growth path rests on its ability to translate existing strengths into structural competitiveness. Demographic depth, proximity to the U.S., and a broad trade network are already in place; the next step is leveraging them to build advanced industrial capabilities.

This means moving from labor-cost advantages toward higher-value ecosystems in semiconductors, EVs, aerospace, and medical technology. Nearshoring momentum has already sparked investment in these areas, but sustained progress will depend on parallel reforms in energy, infrastructure, and governance.

If Mexico can unlock its renewable potential while addressing grid and water constraints, it will not only supply cleaner energy to industry but also align with global ESG standards, making it a preferred destination for responsible investment.

Ultimately, Mexico’s resilience lies in combining geography with reform. Should institutional improvements accompany private investment, the country could become Latin America’s first advanced industrial economy, cementing its role as the linchpin of a regionalized world economy.

Conclusion

Nearshoring to Mexico is more than a cost-saving exercise, it is the redefinition of global supply chains in an era of regionalization. Mexico combines the hard assets of location, infrastructure, and trade alignment with the soft advantages of workforce skills, ESG compliance, and governance improvements. This dual strength explains why it is attracting investment across sectors from EVs and aerospace to medical devices and semiconductors.

Challenges remain, energy bottlenecks, security concerns, and institutional reforms must be addressed for Mexico to fulfill its long-term potential. Yet these risks are increasingly outweighed by the vulnerabilities of distant supply chains and the mounting pressures of energy, shipping, and geopolitical volatility. In a fragmented global economy, resilience and predictability are worth as much as cost efficiency.

The road ahead positions Mexico not on the periphery of globalization but at its new center. By bridging North America with Europe, Asia, and the rest of Latin America, Mexico is emerging as the linchpin of the world’s most dynamic trade triangle. For companies recalibrating their strategies, the choice is no longer simply whether to nearshore, but how quickly they can make Mexico a cornerstone of their future supply chains.